What is the current tax rate in Pennsylvania?

The state sales tax rate in Pennsylvania is 6.000%. With local taxes, the total sales tax rate is between 6.000% and 8.000%. Select the Pennsylvania city from the list of popular cities below to see its current sales tax rate.

What is the average property tax for Pennsylvania?

The PA property tax rates vary from county to county. Local governments within the state use various methods to calculate your real property tax base. Overall, Pennsylvania has property tax rate that exceeds the national average. The average effective property tax rate in Pennsylvania is 1.58%, compared to the national average of 1.08%.

Does PA have a state income tax?

Residents pay Pennsylvania state income tax at a flat rate of 3.07%. 1 All Pennsylvanians pay 3.07%, no matter how much income they have, unlike with the progressive tax system that's imposed by the federal government and most other states. A progressive system taxes income at a higher percentage as you earn more.

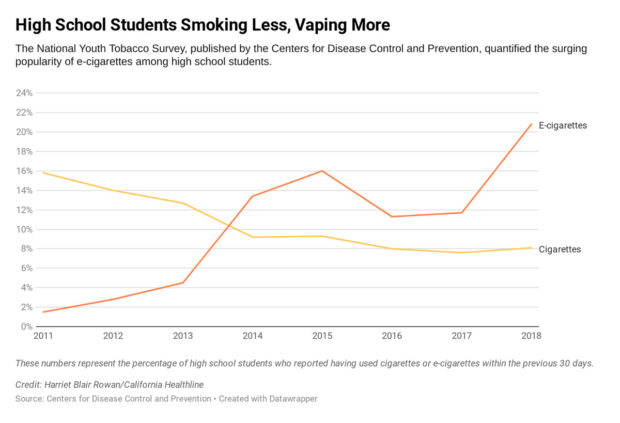

Is vaping legal in PA?

Yes, it is legal to vape in Pennsylvania if one is over the age of 21. However, if you are under 21 it is illegal to consume/purchase e-cigarette related merchandise. What is the legal vaping age in Pennsylvania? The legal vaping age in Pennsylvania is 21 years old.

What is the tax on vape products in PA?

40 percentE-cigarettes/Vapor products The tax rate for e-cigarettes is 40 percent of the purchase price from the wholesaler on the following: Electronic cigarettes — defined as an electronic oral device, such as one composed of a heating element and battery, electronic circuit or both.

When did vape tax start?

Thirty U.S. states plus the District of Columbia kicked off the new year on January 1 with taxes on vaping products and e-cigarettes in place.

Does PA have a tobacco tax?

Cigarette tax is an excise tax on the sale or possession of cigarettes and little cigars in Pennsylvania. Effective August 1, 2016, the state tax rate is $2.60 per pack of 20 cigarettes or little cigars ($0.13 per stick), or $26 per carton of 10 packs.

Is vaping taxed?

The government has claimed it has no plans to impose an excise duty on vaping and non-tobacco nicotine products.

What states have a vape tax?

Table KeyStateVape Tax/ E-Cig TaxIs Non-Nicotine E-Liquid Taxable?New Jersey10% of retail open, $0.10/ml closedNoNew Mexico12.5% of VALM open, $0.50/cartridge closedYesNew York20% retailYesNorth Carolina$0.05/mlNo47 more rows

What is the federal tax on vapes?

Gavin Newsom has signed into law a new excise tax on electronic cigarettes. Amid concern over widespread teen vaping, Gov. Gavin Newsom on Monday approved a new 12.5% excise tax on electronic cigarettes to be paid by California consumers to boost public health and education programs.

Does Pennsylvania have a cigar tax?

"Pennsylvania is one of the only two states not to have a cigar tax," Miskin added. With the exception of the new proposed cigarette tax, details of the levies being considered for the other products are unknown.

Do you need license to sell vape?

States typically require retailers that sell cigarettes or other tobacco products to obtain a license or permit from the state or local government. A growing number of states and local communities are now requiring e-cigarette retailers, including vape shops, to obtain licenses or permits.

Is PA a non smoking state?

Pennsylvania Clean Indoor Air Legislation Beginning on September 11, 2008, smoking is not allowed in public places or workplaces. The CIAA defines a "public place" as an enclosed area which serves as a workplace, commercial establishment, or an area where the public is invited or permitted.

What is a bottle surcharge on vape juice?

Bottle Surcharge - your city's and state's taxes for nicotine-containing products or related vape accessories.

Why is there a bottle surcharge on vape juice?

California requires an excise tax on e-liquids and tobacco-free nicotine products that is equal to 63.49% of the wholesale price. Nicotine-free liquids are excluded from this tax.

How much are NJOY pods at a gas station?

$9.99The magnetic flavor pods come in packs of two and cost $9.99 for the pack. Pop one out of the package and remove the rubber plugs from the bottom and top of the pod. Those are there to prevent any possible leaking from the pods in transit.

How long is the grace period for small businesses?

The three-month grace period may allow some shop owners to find a way to afford it — although many may be unable to. However the tax is collected, the fact is that small businesses will be forced to hand the state cash amounting to 40 percent of the value of all merchandise in their stores, or shut their doors.

Can you go to jail for buying vapor products online?

Pennsylvania vapers could go to prison for buying vapor products online and not paying a 40 percent tax on them. “The penalties for evading the tax include up to a $5,000 fine, or prison time not to exceed five years,” Alex Clark of CASAA told me in an e-mail.

Which states do not have excise taxes on vaping?

However, out of the states that do tax vaping products, one of the lowest is percentage-based taxes is New Hampshire at 8% of wholesale price for open vaping products. Delaware, Kansas, Louisiana, North Carolina, and Wisconsin are also some of the lowest at $0.05/ml.

What is the difference between open and closed vaping?

Some states tax open and closed vaping products differently. Open: allows the user to refill the liquid and has more freedom in voltage and nicotine levels. Closed: Usually sold as pods or cartridge. Closed systems often have higher nicotine levels to allow for consumption of the desired amount of nicotine in shorter sessions.

What is an electronic cigarette?

Electronic cigarette means “ (1) an electronic oral device, such as one composed of a heating element and battery or electronic circuit, or both, which provides a vapor of nicotine or any other substance and the use or inhalation of which simulates smoking. (2) The term includes (i) [a] device as described in paragraph (1), ...

Is electronic cigarettes allowed in schools?

Electronic cigarettes prohibited in schools, on school vehicles and on school property owned or leased or under the control of a school district. 18 Pa. Cons. Stat. § 6306.1 (2021)

When will Indiana vape tax be imposed?

The new tax will be 25% of wholesale cost on closed-system products like prefilled pods, and 15% at retail (a sales tax) on open-system products like bottled. The tax will take effect July 1, 2022.

What states have a tax on vaping?

Louisiana. A $0.05 per milliliter tax on nicotine-containing e-liquid. Maine. A 43% wholesale tax on all vaping products. Maryland. A 6% sales tax on all open-system vaping products (including e-liquid) and a 60% tax on e-liquid in containers with a capacity under 5 milliliters (pods, cartridges, disposables).

How much is e-liquid taxed in New Jersey?

New Jersey taxes e-liquid at $0.10 per milliliter in pod- and cartridge-based products, 10% of the retail price for bottled e-liquid, and 30% wholesale for devices. New Jersey legislators voted in January 2020 to essentially double the two-tiered e-liquid tax, but the new law was vetoed by Governor Phil Murphy.

Why is vaping a tax target?

Because vapor products are usually bought by smokers and ex-smokers, tax authorities correctly assume that money spent on e-cigarettes is money not being spent on traditional tobacco products. Governments have depended upon cigarettes ...

What is wholesale tax?

Wholesale taxes are ostensibly charged to the wholesaler (usually a distributor) selling products to a business that will resell them at retail sites in the state. The tax is usually a percentage of the wholesale price (cost). It may be assessed on all vaping products or just nicotine-containing ones.

What is the tax on e-liquid in Colorado?

For the year beginning July 1, 2020, the tax is 56.93% of the wholesale cost for all nicotine-containing products. Colorado. In 2020, Colorado voters approved an escalating tax on nicotine-containing vapor products (including bottled e-liquid) that mirrors the Colorado tax on non-cigarette tobacco products.

What boroughs have 45% tax?

Juneau Borough, NW Arctic Borough and Petersburg Borough have identical 45% wholesale taxes on nicotine-containing products. Anchorage Borough has passed a 55% wholesale tax, which will take effect Jan. 1, 2021. Matanuska-Susitna Borough has a 55% wholesale tax. California.

Did the IRS screen contractors?

The IRS failed to screen two-thirds of agency contractors for tax delinquencies and other errors, according to a new TIGTA report . This serves as yet another example of the IRS’s inability to complete basic tasks, even when it is required of them.

Does Pennsylvania have a vape tax?

Vapers in Pennsylvania won a small, but important victory last week at the Pennsylvania Commonwealth Court. Since 2016, Pennsylvania has levied a 40% tax on electronic cigarettes and vapor products. East Coast Vapor, a Pennsylvanian vape shop, brought the tax to trial on the grounds that most vaping products lack tobacco, the defined product subject to the excise tax.